Hello Friends of SAVE,

We are pleased to announce that our Kids Biz Club economics course will be offered to 5th grade students at Roosevelt Elementary School in Bellingham this fall!

How you can help to bring this program to 5th graders in Bellingham.

We are offering this program at a cost of $200 per student. This covers the cost of teachers. You can help with a direct donation to SAVE at https://savenw.org/donate or mail a check to SAVENW, PO Box 29753 Bellingham, Wa 98227-1753. Name KBC on your donation and it will go directly to this program.

We would like to hire another Tech Teacher to work with us and learn the program so that we can expand the program. If you know someone who has time on Tuesday and Thursday afternoons have them contact us at

Our thanks to John Westerfield, from Yeager’s Sporting Goods for volunteering to be the guest speaker for our course at Roosevelt Elementary this Fall. If you know someone who would also like to assist us at Roosevelt as a volunteer, have them contact us at

For the fun part, check out Roosevelt PTA’s Pint Nite, Tuesday, September 24th, 6-9 PM. The PTA will be using funds for scholarships to the Youth Enrichment programs, including Kids Biz Club.

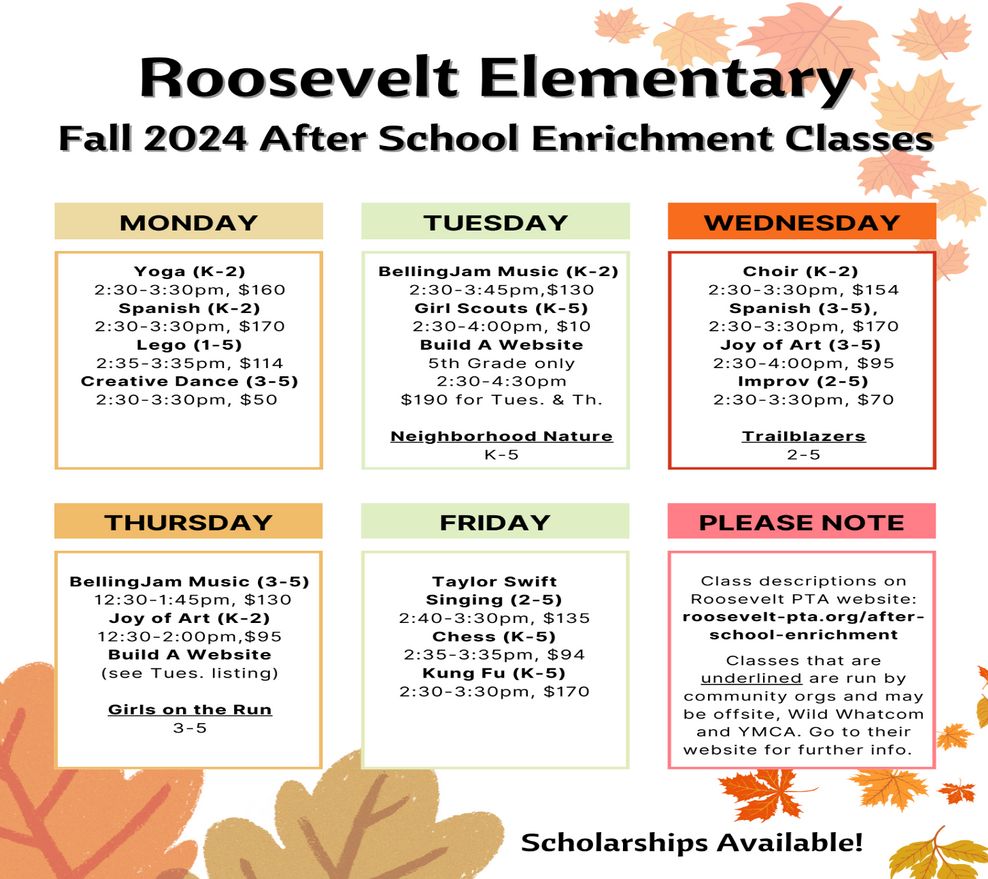

Roosevelt Elementary Enrichment including

Kids Biz Club Build a Website

Tuesdays and Thursdays

You are invited to attend Beer and Bingo - an opportunity to support Kids Biz Club Build a Website and Roosevelt School Scholarships - on Tuesday September 24, 2024 from 6 pm to 9 pm

Join SAVE in Supporting

Roosevelt Elementary After School Programming Scholarships.

See you there!

Social Alliance for a Vibrant Economy (SAVE) POB 29753 Bellingham WA 98227-1753

Many people say that they donate to charitable causes to “give back” for being successful in business or their life. We assume that their success was due to luck or rich parents. Yet if you look at their circumstances more closely, it probably was because of hard work, ethical principles and choosing an education that prepared them for success.

Many people say that they donate to charitable causes to “give back” for being successful in business or their life. We assume that their success was due to luck or rich parents. Yet if you look at their circumstances more closely, it probably was because of hard work, ethical principles and choosing an education that prepared them for success.